DMI Finance Private Limited is a leading Non-Banking Financial Company (NBFC) in India, focused on providing innovative digital financial solutions. With a strong emphasis on technology and customer-centric approach, DMI Finance has emerged as a prominent player in the country’s burgeoning digital lending landscape.

A Brief Overview

Founded in 2008, DMI Finance has rapidly grown into a trusted financial institution, catering to the diverse needs of individuals and businesses. The company offers a wide range of financial products, including:

- Personal Loans: Flexible and affordable personal loans to meet various financial needs, such as home renovations, medical emergencies, or travel expenses.

- MSME Loans: Tailored financing solutions for small and medium-sized enterprises to fuel their growth and expansion.

- Consumer Loans: Convenient loans for purchasing consumer durables like electronics, appliances, and vehicles.

The DMI Finance Advantage

What sets DMI Finance apart is its commitment to providing a seamless and hassle-free borrowing experience. Key advantages include:

- Swift Approval Process: Leveraging advanced technology, DMI Finance offers quick loan approvals, ensuring timely access to funds.

- Minimal Documentation: The company streamlines the loan application process by requiring minimal paperwork, saving time and effort for customers.

- Transparent Terms and Conditions: DMI Finance maintains complete transparency in its loan terms and conditions, empowering customers to make informed decisions.

- Flexible Repayment Options: The company offers flexible repayment schedules to suit individual needs and financial capabilities.

- Strong Customer Support: DMI Finance provides dedicated customer support to address queries and concerns promptly and efficiently.

DMI Finance’s Impact on the Indian Financial Landscape

DMI Finance has made significant strides in promoting financial inclusion in India by extending credit to underserved segments of the population. By leveraging technology, the company has been able to reach a wider customer base and offer affordable financial solutions.

Moreover, DMI Finance’s focus on digital lending has contributed to the growth of the Indian fintech industry. The company’s innovative approach has set new benchmarks for the sector, inspiring other financial institutions to adopt digital technologies.

Conclusion

DMI Finance Private Limited is a dynamic and forward-thinking financial institution that is shaping the future of digital lending in India. With its customer-centric approach, innovative products, and strong commitment to financial inclusion, DMI Finance is well-positioned to continue its growth trajectory and empower individuals and businesses across the country.

Frequently Asked Questions (FAQs) about DMI Finance

General Questions

What is DMI Finance?

DMI Finance Private Limited is a leading Non-Banking Financial Company (NBFC) in India, offering a range of financial products like personal loans, MSME loans, and consumer loans.

Is DMI Finance a reliable financial institution?

Yes, DMI Finance is a reputable and trusted financial institution with a strong track record of providing reliable financial services.

How can I contact DMI Finance?

You can contact DMI Finance through their official website, mobile app, or by visiting one of their branches. You can also reach out to their customer support team via phone or email.

Loan-Related Questions

What documents are required to apply for a loan?

The specific documents required may vary depending on the type of loan and the applicant’s profile. However, generally, you may need to provide identification proof, address proof, income proof, and bank statements.

What is the eligibility criteria for a loan?

Eligibility criteria may vary based on the loan type and lender’s policies. Generally, you should be an Indian citizen, meet certain age and income criteria, and have a good credit history.

How long does it take to get a loan approved?

DMI Finance offers a quick and efficient loan approval process. With advanced technology and streamlined procedures, you can often get loan approval within a short timeframe.

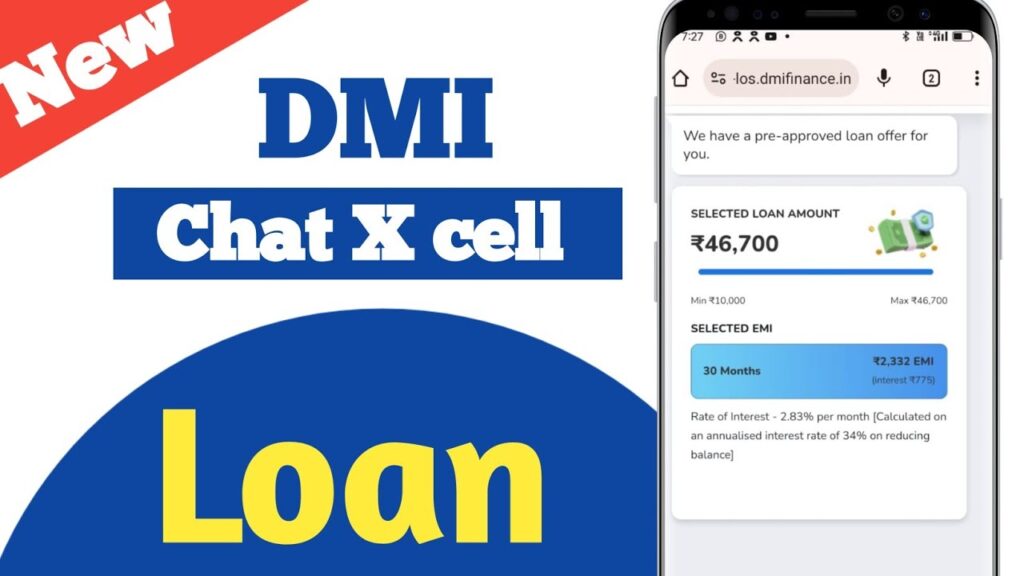

What are the interest rates on DMI Finance loans?

Interest rates on DMI Finance loans may vary depending on various factors such as loan amount, tenure, and your creditworthiness. It’s best to check with DMI Finance directly for the latest interest rates.

How can I repay my loan?

DMI Finance offers flexible repayment options, including online payments, bank transfers, and through their branches.

For more specific information, please visit the official DMI Finance website or contact their customer support.