Introduction

HDFC Bank, one of India’s leading private sector banks, offers a wide range of financial products and services, including personal loans. While these loans can be a valuable financial tool, there might come a time when you wish to repay the loan before its scheduled tenure. This process, known as pre-closure, can be conveniently done online through HDFC Bank’s digital platforms. In this comprehensive guide, we will walk you through the step-by-step process of closing your HDFC personal loan online.

Understanding HDFC Personal Loan Pre-Closure

Before diving into the online process, it’s essential to understand the key aspects of pre-closure:

- Pre-Closure Charges: HDFC Bank may levy certain pre-closure charges, which vary depending on the loan tenure and other factors. It’s advisable to check with the bank to get the exact amount.

- Required Documentation: While the online process is primarily paperless, you might need to submit certain documents, such as a pre-closure request form and proof of payment.

Step-by-Step Guide to HDFC Personal Loan Online Closure

- Log in to Your HDFC NetBanking Account:

- Visit the official HDFC Bank website.

- Log in to your NetBanking account using your customer ID and password.

- Navigate to the ‘Loans’ Section:

- Once logged in, look for the ‘Loans’ section on the main dashboard.

- Click on the ‘Personal Loan’ option.

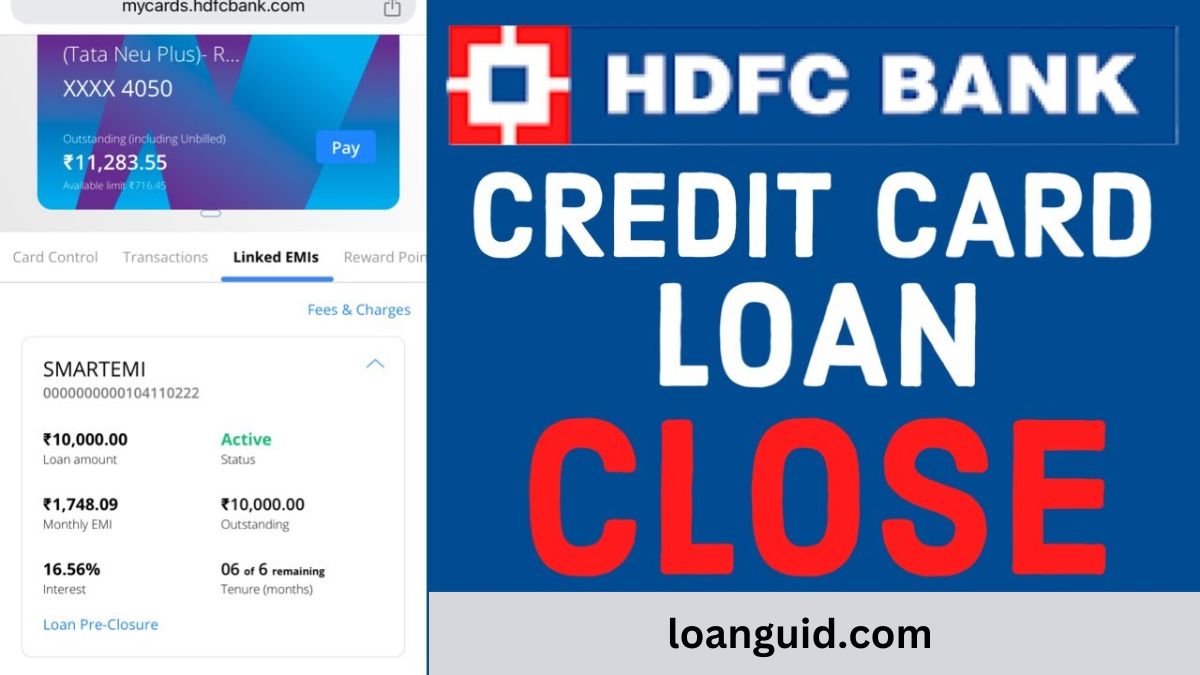

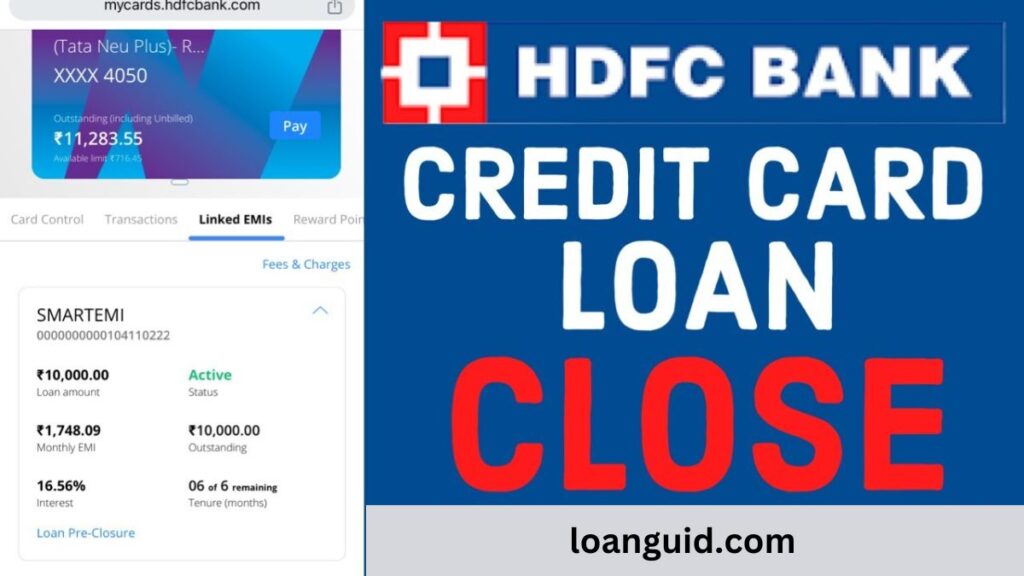

- Select ‘Pre-Closure’ Option:

- Within the Personal Loan section, you should find an option to ‘Pre-Close Loan’.

- Click on this option to initiate the pre-closure process.

- Provide Required Information:

- The system will prompt you to provide certain details, such as the amount you wish to prepay and the reason for pre-closure.

- Ensure that you provide accurate information.

- Confirm Pre-Closure:

- Review the details and confirm your pre-closure request.

- You might be required to authorize the transaction using a One-Time Password (OTP) sent to your registered mobile number.

- Make the Payment:

- You can make the pre-payment through various online channels offered by HDFC Bank, such as:

- NetBanking

- Mobile Banking

- UPI

- Credit Card

- Debit Card

- Verify Pre-Closure:

- Once the payment is processed, you will receive a confirmation message from the bank.

- You can also verify the pre-closure status by logging into your NetBanking account or contacting HDFC Bank’s customer care.

Additional Tips for a Smooth Pre-Closure Process:

- Check Pre-Closure Charges: Before initiating the process, clarify the exact pre-closure charges with the bank.

- Plan Your Payment: Ensure you have sufficient funds in your account to cover the outstanding loan amount and any applicable charges.

- Keep Documents Ready: Although the process is primarily online, it’s wise to keep relevant documents handy, such as your loan agreement and identification proof.

- Contact Customer Care if Needed: If you encounter any difficulties during the online process, don’t hesitate to contact HDFC Bank’s customer care for assistance.

Conclusion

HDFC Bank’s online platform offers a convenient way to pre-close your personal loan. By following the steps outlined above, you can streamline the process and complete it efficiently. Remember to carefully review the terms and conditions, including pre-closure charges, to avoid any unexpected costs.

5FAQs about HDFC Personal Loan Online Closure

What are the pre-closure charges for an HDFC personal loan?

Pre-closure charges vary depending on the loan tenure and other factors. It’s best to contact HDFC Bank’s customer care or visit their website to get the exact charges applicable to your specific loan.

Can I pre-close my HDFC personal loan partially?

Yes, you can partially prepay your HDFC personal loan. However, the minimum prepayment amount and any applicable charges may vary.

Is there a specific time frame to pre-close my HDFC personal loan online?

You can typically pre-close your loan online at any time, 24/7. However, the processing time may vary.

What documents are required for online pre-closure of an HDFC personal loan?

Usually, no physical documents are required for online pre-closure. However, it’s advisable to keep your loan agreement and identification proof handy in case of any verification.

What happens to my loan account after pre-closure?

Once your loan is fully pre-closed, your loan account will be closed. You will receive a confirmation from the bank regarding the closure.

-

Personal loan pre-closure: 4 key factors to consider before paying off early

[ad_1] Have you recently received a lumpsum payment in the form of an annual bonus … Read more

-

Mutual Funds: Does the date of SIP make a difference to the long term wealth creation?

[ad_1] If you are planning to invest in a mutual fund, then the better way … Read more

-

Managing finances across borders? Finding the right collaborators is crucial.

[ad_1] Receiving an inheritance can be complex, especially if it involves cross-border transfers. Diya (name … Read more